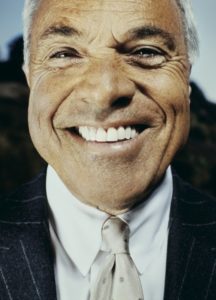

Countrywide Financial May Be Gone But It’s America’s Wholesale Lender Scam Is Creating Title Nightmares Decades Later

MFI-Miami has been receiving lots of phone calls lately about the now-defunct Countrywide Financial’s America’s Wholesale Lender scam.

Distraught title agents and homeowners are calling MFI-Miami in a panic. They are asking what to do about mortgage liens under the name America’s Wholesale Lender.

These mortgages are from over 15 years ago. They have never been discharged or recorded on the public record as being satisfied.

Thus, this creates a title nightmare for homeowners trying to sell their home or refinance.

Countrywide Financial created America’s Wholesale Lender around 2001 to separate loans originated by their wholesale division and their retail divisions.

If your mortgage says, America’s Wholesale Lender, you need to call us at 888.737.6344. You could be a victim of a multi-billion dollar fraud.

How Countrywide’s America’s Wholesale Lender Scam Worked

Countrywide began using the name around 2001 to determine which loans were originated on the wholesale market.

Countrywide Financial claimed America’s Wholesale Lender was a DBA of Countrywide Home Loans. The problem is it’s not. The corporation and/or the DBA never existed. Let me explain.

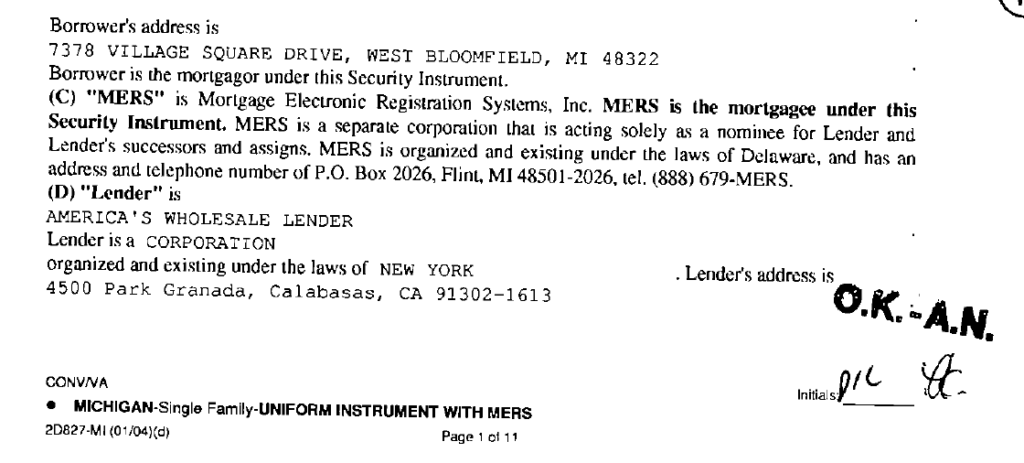

Any mortgage or Deed of Trust issued by Countrywide Home Loans that names America’s Wholesale Lender as the “Lender”, is usually followed by “Lender is a Corporation organized and existing under the laws of New York”

It usually looks like this:

However, America’s Wholesale Lender is and was never a New York corporation. There is no indication Countrywide ever incorporated America’s Wholesale Lender. Nor did they ever file for an assumed name in any county in New York State. Was this corporate mismanagement or blatant fraud? Who knows?

America’s Wholesale Lender Scam Creates Huge Problems For Bank of America

Regardless if Countrywide intentionally committed fraud or not, this currently creates two major issues for Bank of America.

Regardless if Countrywide intentionally committed fraud or not, this currently creates two major issues for Bank of America.

Why Bank of America?

The Bush Administration pressured Bank of America to purchase the near insolvent Countrywide Financial in 2007.

However, Bank of America’s solution to this problem was simple.

They haphazardly dumped the loans and the servicing on the secondary market when America’s Wholesale Lender became an issue after the financial crisis.

It seemed like they did it faster than Saul Goodman clearing out his office at the end of Breaking Bad.

First, these mortgages show Countrywide misled homeowners as to who their lender was right out of the gate. Second, America’s Wholesale Lender was not and never was a New York Corporation.

Countrywide trademarked the name (Reg. #1872784). However, they never incorporated America’s Wholesale Lender as a corporation in New York. The now-defunct lender also failed to file DBA papers in Manhattan or any other county in New York.

An America’s Wholesale Lender is incorporated in New York. However, it has no connection with Countrywide or Bank of America. I’ll get to that later.

Was MERS In On Countrywide’s America’s Wholesale Lender Scam?

As a result, this also creates a huge liability for MERS. MERS allowed Countrywide to register loans from a non-existent entity into its registry.

As a result, this also creates a huge liability for MERS. MERS allowed Countrywide to register loans from a non-existent entity into its registry.

In addition, it also creates a huge liability to the people that MERS authorized to sign on their behalf.

MERS can only act as a nominee for its members. It can also only assign the mortgagee rights for its members.

Furthermore, MERS had to know America’s Wholesale Lender was NOT, and NEVER was a MERS member. MERS and its signatories should have known that America’s Wholesale Lender was NOT and NEVER was a New York corporation.

MERS and people who have signed as MERS executives could find themselves facing fraud lawsuits.

As a result, MBS Trusts and Bank of America would also be left holding unenforceable mortgages.

Multiple Groups Also Committed An America’s Wholesale Lender Scam

After BofA acquired Countrywide, a couple of scam artists incorporated a fake America’s Wholesale Lender in New York in 2008.

After BofA acquired Countrywide, a couple of scam artists incorporated a fake America’s Wholesale Lender in New York in 2008.

The goal of these scam artists was easy. They wanted to score some free properties from the chaos of the financial crisis.

This LLC has and had no connection to Countrywide or Bank of America.

Dennis L. Bell and a group of real estate fraudsters filed this fake LLC with the state of New York.

Bell and his friends hoped to cash in on the chaos of the foreclosure crisis. Their goal was to create bogus mortgage assignments and loan satisfactions to score free houses.

America's Wholesale Lender -NY Filing

As a result, Bank of America sued Bell in 2012 after the bank discovered title fraud going on in California. BofA also alleged Bell had an extensive criminal record in Missouri.

As a result, Bank of America sued Bell in 2012 after the bank discovered title fraud going on in California. BofA also alleged Bell had an extensive criminal record in Missouri.

They also allege Bell had a long history of committing mortgage fraud. In addition, the bank also claimed Bell teamed up with Jan Van Eck and Cheri B. English to record fraudulent reconveyances in California.

These reconveyances falsely released liens on California properties with mortgages originated by Countrywide Home Loans.

In addition to filing fake lien satisfactions, the three fraudsters also filed bogus judgments in California state courts.

These judgments also purport to modify or cancel mortgages on California properties with Countrywide mortgages.

Bell admitted to the America’s Wholesale Lender scam as a result of a lawsuit he filed against Van Eck.

Ironically, he sued Van Eck for fraud in Federal Court in Connecticut. (America’s Wholesale Lender, Inc. v. Van Eck, Civil No. 11-cv-1493 (CFD) (TPS)). In the lawsuit and under oath, Bell also admitted to being part of the scam.

You can read Bank of America’s lawsuit America’s Wholesale Lender below:

Susan Sissom 14:01:59 pm May 14, 2020

My “lender” was America’s Wholesale Lender! I have been fighting this for years, but in the end I lost my home to all the corrupt people involved in my case! Thanks to all of the corruption in each and every court I had to deal with! This includes state, federal and appeals courts. Judges, County Clerks, lawyers, and everyone else who had a hand in this! I was granted a Temporary Restraining Order by the District Judge on the day they were going to foreclose on my home and less than two hours later they foreclosed on me anyway! They actually went over the top of a District Judge’s TRO and NOTHING happened to them! I was served a “COURT WARNING “ by a Deputy Sheriff and have to vacate by January 15, 2022. There are so many things that I went through it’s just too much to type! Great Justice System we have in this country! America’s Wholesale Lender is and never was a company! Complete fraud going on and innocent people, like myself had their homes stolen from them!